The Great Bank Heist

A simple blog for you today. But an important one. The OBR forecast nobody wants you to see.

Cameron, Clegg, Osborne and lackeys thereof, keep making the household debt analogy. What would you do if you owed more money than was coming in? You would have to cut spending, right? Manage your debt.

Ironic then, that the government’s current fiscal policy has a very simple and direct effect on YOUR household debt. This is, in my opinion, one of the most vital (and at the same time the most under-publicised) statistics to come out of the Office for Budget Responsibility:

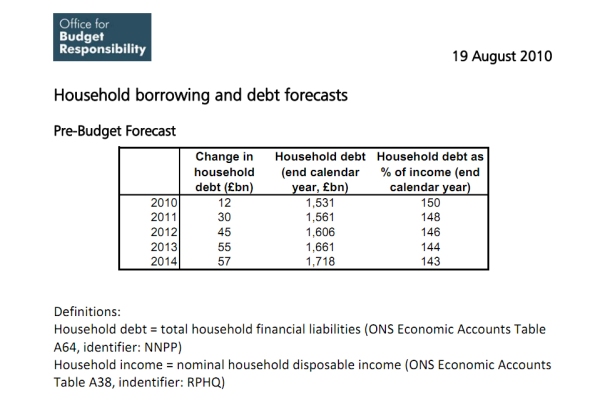

Ahead of Osborne’s emergency budget, the forecast of the OBR for household debt (i.e. the money an average UK household owes, incl. secured loans like mortgages) had been:

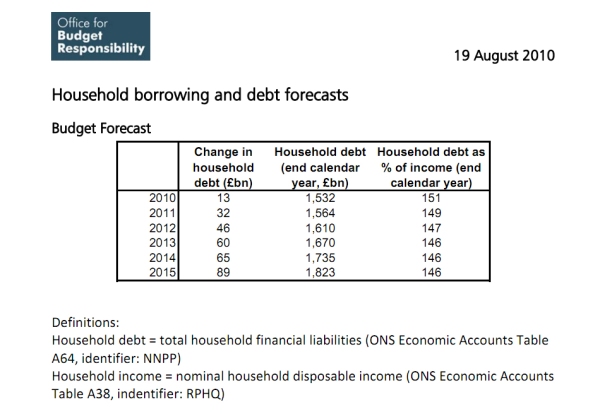

This showed a predicted decrease of household debt as a percentage of household income, from 150% in 2010 to 143% in 2014. This had to be revised for Osborne’s emergency budget:

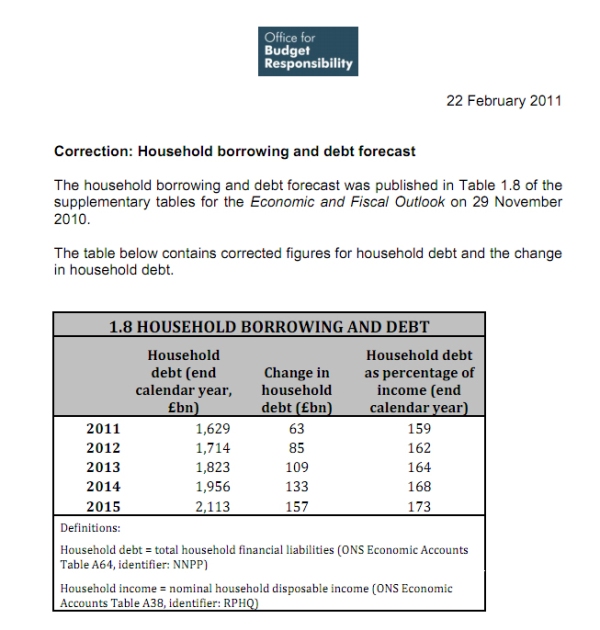

The decrease is now less sharp between 2010 (151%) and 2014 (146%) and actually flat-lines in the last three years of the forecast. Ahead of Osborne’s recent budget, however, as the cuts bite and growth stutters, the OBR had to issue a correction, dramatically revising their forecasts to:

Not only are they no longer looking at a decrease in household debt. They are looking at a STONKING 20% increase over the next five years, from the original prediction of 143% pre-Osborne. In money terms, almost £500 billion is being added to MINE and YOUR personal debt. And this doesn’t even take into account the inevitable, approaching interest rate hike.

Not only are they no longer looking at a decrease in household debt. They are looking at a STONKING 20% increase over the next five years, from the original prediction of 143% pre-Osborne. In money terms, almost £500 billion is being added to MINE and YOUR personal debt. And this doesn’t even take into account the inevitable, approaching interest rate hike.

And so if you are wondering how the Conservatives can cut the national debt so much quicker than anyone else had forecast or advised, that any country abroad is having to do, this is how it is done: A simple transfer of state debt, bank-bail-out money debt, let’s-fight-a-war-in-Iraq debt from UK PLC to UK MUGS LTD.

And I don’t say that. The OBR, the independent government watchdog over money matters, says that.

UPDATE: Somebody commenting on this post in a forum said: As for the government “leaving the figures out of the book” or having a set of figures that “nobody wants you to see” – thereby implying they have something to hide – I think you’re being a tad harsh. If I was obliged to issue these figures and hoped to God that they’d somehow be glossed over, the very last thing I’d do is issue a special press release where this was the only thing being presented. I did a little research and this was my reply:

On this point, I think you are being a tad naive. I have worked in the civil service for many years. It is entirely bizarre, with a budget coming up in a months time for the revision to not be simply included in that, but be issued as a correction. There was no special press release, instead the OBR issued a release saying they would be updating some figures – very bland and giving absolutely no detail – and the correction just popped up on the Publications bit of their website.

And now put it in its “historical” context of that day. What else was happening? The Libya crisis was at its absolute peak – on that day started the botched evacuation, BP declared its workers not safe, Gaddafi made famous telecast saying he will get all dissidents from their lairs. 24hr coverage. That same day was the health worker’s union announcement that 50,000 NHS jobs were being cut. Rooney’s blackmail plot suspects were arrested.

Oh yes. And the Christchurch earthquake had happened in the early hours of the morning. What was that famous phrase that got Jo Moore in trouble? “A good day to bury bad news”?

Trackbacks

- Tax Research UK » You’re going to pay for the cuts in the government’s deficit - by going into seriously into debt

- What a difference six months makes | ToUChstone blog: A public policy blog from the TUC

- You’re going to pay for the cuts in the government’s deficit - by going into seriously into debt | called2account

- Why Ed Miliband was right to attend Saturday’s TUC march | Liberal Conspiracy

- Osborne’s plans don’t add up « Liberal Eye

- Private and public debt « Same old played out scenes

- Time to refocus on the Banks « sturdyblog

- What exactly DO we want to leave to our children? « sturdyblog

- Osborne’s Stand Up Routine « sturdyblog

- Osborne’s Plan A (Beta v.4.021) « sturdyblog

Good heavens what next?

Could you expand on the relationship between the following:

1. 20% increase in household debt over the next 5 years

2. What the compounded increase would be over 5 years using RPI of 5.5% (as we have at the moment)?

Thanks.

Hi Sturdy

Posted a link to this article on facebook and had the following response from a banking type friend – if you have time, would you reply?

Cheers

“That’s a particularly weak article. Who writes that drivel? The government has no role in private sector lending, the BOE sets the interest rate and last time I checked UK banks were pretty damn averse to lending to businesses so, ceteris paribus, there’s little chance for any individual wanting a similar loan. What is a more interesting question to ponder is how the UK economy recovers without monetary stimulus to aid growth, because as inflation creeps further the inevitable interest rate rise will dampen lending even further.

So, if as the article posits, a recovery strategy based on households getting into more debt then the government would be doing all it could to stimulate lending, i.e. borrowing more itself and then on-lending with a haircut. I’m interested to hear how they think the government is going to ‘transfer’ overall country debt to households in the UK.That boggles the mind and exceeds even the usual miscomprehension of the bank bashing brigade.”

There is a well-established concept in law. It is known as res ipsa loquitur which translates as “the thing speaks for itself”. It was simply expressed in Ybarra v. Spangard – a patient undergoing surgery experienced back complications as a result of the surgery, but it could not be determined exactly which member of the surgical team had breached his or her duty, and so it was held that they had all breached, because it was certain that at least one of them was the only person who was in exclusive control of the instrumentality of harm.

I could try and unpick which particular target at which the government is failing is the primary contributor to the revised prediction. It could be the soaring inflation or the downgrading of growth forecasts or the rising unemployment. The res ipsa loquitor principle would simply say this is happening while the current government are operating on the patient (the economy) and so it is largely irrelevant, in terms of precise blame, why the patient is flat-lining.

Nevertheless, let me just give you one practical example of how this transfer can occur, that pops large into my mind. Let us say that a two income family is reduced to one income, because one of them is made redundant by a government department, or that their salaries have been frozen because they are both police officers, or that they have to spend a large sum of money to install a ramp for grandma because the council no longer has a duty to do it. They have been paying the mortgage on their house for over a decade and have good positive equity in their property. They remortgage this property to cope with the results of the austerity measures this government is imposing, thus increasing their household debt. I personally know dozens of people who got into debt in this way during the 80’s recession. Your banker friend may not know any.

End of drivel.

To add to your reply, if I may. There are dozens of ways in which household debt will increase.

Just a few:

Falling behind on mortgage payments/rent.

Increasing borrowing on credit cards/failure to pay off credit card loans.

Falling behind on loan agreements.

Falling behind on utility payments.

Falling behind on council tax.

That household debt nationally is likely to rise, is hardly a surprise when average earnings are falling, unemployment is rising, interest rates are likely to rise, and inflation is soaring away.

Jonnyhotrod’s banker friend clearly isn’t living in the real world – but, I suppose, few bankers are.

good article, ignore the banker drivel.

I wrote something similar about the impact of the Con-Dems policies (without the hard facts) after Mervyn King’s speech about falling living standards akin to the 1920s. Monday saw Panorama revealing that living standards have now fallen to 2004 levels.

If you cut people’s incomes then they will either re-adjust or borrow more. There will be a debt-driven economic stimulus just like the last one. The result will be the same, a burst bubble at some time.

The other way is if the planned privatisation of much of the welfare state goes through. The government will then be transferring a state service to one purchased by the individual (to a great or lesser degree depending on service). People will then have to buy greater amounts of services while the government cuts taxation to the multinationals.

More profits from welfare and from an indebted population is the policy of finance.

Why on earth anyone would still be listening to a banker who hasn’t spend the last decade or three jumping up and down, screaming “it’s all a giant scam – stop this madness right now!” is beyond me.

Great blogging. Thanks.

PS: Presumably some of this projected debt is from home repossessions? Unlike the US, where you can just hand your keys back, in the UK the bank will take your house, sell it off for a quick profit, and then still chase you for the negative equity.

The one sensible thing Banker Boy said is that this amount of debt is not going to come from banks being willing to lend it. There is no realistic plan for growth. The Chancellor wears no clothes.

Handy Krugman column today – http://is.gd/nsSIo7 – connecting to a heap of useful resources on the effects of austerity budgets.

People don’t just borrow money from banks. There is a thriving industry of legal loan sharks out there, ranging from payday lenders, pawnbrokers, shops like Moneyshop, doorstep lenders etc which charge interests rates running into the thousands per annum.